Thoughts from the Franklin Templeton Fixed Income Team.

The Australian Bloomberg Ausbond Composite Bond Index just completed its worst monthly return IN HISTORY with February returning a whopping -3.59% as bonds crumbled.

We like to think the dysfunctional market conditions of March 2020 won’t be repeated for a long time, if ever. Last week saw some serious tremors in global bond markets which, whilst not as serious as March 2020, will have concerned central banks who remain committed to keeping policy settings ultra stimulatory for longer and who don’t want bond markets to undo all their hard work.

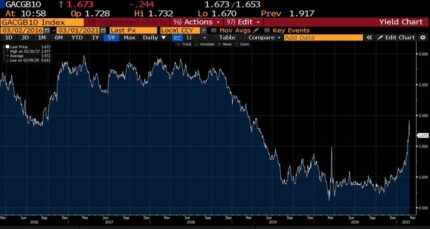

The Australian 10 year government bond effectively flash crashed with yields at one point last week spiking almost 90bps versus the start of February – one of the biggest moves ever. Normally highly liquid bond futures markets exhibited dysfunctionality and erratic moves. The good news is that the RBA displays signs of having learned from last year’s experience, reacting swiftly in recent days with increased purchases as part of its Yield Curve Control policy and, today, announcing that it is also increasing the size of purchases in its Quantitative Easing program.

AUS 10 YEAR YIELDS SOARED TOWARD 2% IN THE WEEK ENDING 26 FEBRUARY.

Source: Franklin Templeton; bloomberg

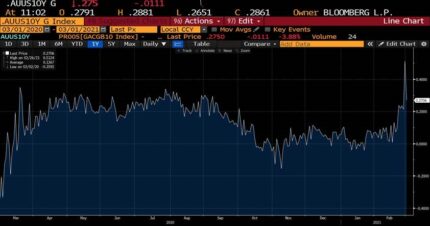

The move was at least in part driven by moves in US Treasuries although the 10 year treasury moved a fraction of the Australian’s equivalent change in yield. This meant the spread between Australian and US 10 year treasuries widened substantially, a key comparative which, as Josh recently highlighted, is one the RBA is focused on. At one point Australian 10 year bonds were 50bps higher in yield than US 10 year yields. Global relativities matter when trying to keep financial conditions easy in the form of both financing costs and the currency from taking off. On the latter the A$ soaring toward US$0.80 is another headache for the RBA.

THE SPREAD BETWEEN AUS AND US 10 YEAR BOND YIELDS SPIKED AS HIGH AS 0.50% AT ONE POINT

Source: Franklin Templeton; bloomberg

The move in yields was not just at the longer 10 year part of the curve but the very short end where central banks are anchoring rates. The RBA’s own Yield Curve Control program was put to the test with government bonds in the 0-3yr target zone trading higher than their target of 0.1% to match the cash rate despite the central bank buying $7bn of securities over last week alone.

With yield curve control, QE and forward guidance of rates on hold for at least 3 years the market is throwing it all back in the RBA’s face. The market moves effectively meant rate hikes starting to be priced from as soon as late next year and certainly into 2 years against an official 3 year target of no change.

What is the narrative? Monster monetary stimulus meets fiscal stimulus meets vaccines being rolled out and a big return to normal later this year. What pandemic? All that stimulus coupled with economies resuming normal service sees inflation take off and central banks having to reel it in.

So two things. Firstly, economies are going to take a lot longer to return to normal than markets think. There is no linear glidepath back to the wellness and goodness of pre-COVID. Yes 2021 is a brighter year than 2020 but we will see a constrained reopening, residual labour market weakness and international border restrictions for several years. The RBA and others have effectively made it clear that employment, and wages are their focus. As Jobkeeper ends at the end of March the risks are that the unemployment rate moves back into the 7‘s from its current 6.4%. Even were it to remain at 6.4%, bear in mind that wages growth was tepid pre-COVID with an unemployment rate of ~5% and that the RBA has explicitly said that wages growth of ~3.5-4% is consistent with inflation getting back into the 2-3% band. This is a multi year process that needs an awful lot to go right.

We are going to see a major tug of war where the risks of inflation are real and build and where the central banks won’t blink until it manifests in ‘full employment’ and wages growth the likes of which we haven’t seen for years and years.

Our view has been and remains that the easy ‘low hanging fruit’ of the Australian recovery is being picked at the moment. The longer term, more difficult part of the recovery with border restrictions retained for longer and a loss of immigration and services exports still to be felt, will validate the RBA’s guidance.

So we haven’t altered our slight duration position in Australian bonds even as we have been positioned for higher yields in the US. Australian yields moving sharply higher even relative to US yields was inconsistent with our thesis which we carefully reexamined. Yesterday morning we saw a sharp retracement of these moves with Australian yields lower by almost 30bps in the 10 year part of the curve alone, the spread between Australian and US bonds narrowing reinforced by the RBA launching a substantial QE buying exercise just this morning to assert its intentions clearly to the market .

The market is likely to learn this week that the resolve of the RBA and central banks such as the Federal Reserve to keep policy settings very stimulatory and peg bond yields lower for longer remains intact. This will mean lower nominal yields even if inflation pressures start to build meaning real yields (nominal yields minus inflation) stay negative. The alternative is an unwanted and premature tightening of financial conditions via higher borrowing costs, strong currencies and, dare we suggest, weaker equity markets.

Source: Franklin Templeton Investments Australia Limited

#centaurfinancial #goldcoastfinancialplanners #financialadvisorgoldcoast #financialplanninggoldcoast