-

Exciting News: We’re Moving!July 5, 2024We are thrilled to announce that the Centaur Financial Services office is relocating to a brand-new space in the Rocket Building at Robina, to better serve our clients. We are proud to have shared our journey from 15 years ago in ‘our shoebox’ at Crowley Calvert and Associates and for the past 5 years at…

Exciting News: We’re Moving!July 5, 2024We are thrilled to announce that the Centaur Financial Services office is relocating to a brand-new space in the Rocket Building at Robina, to better serve our clients. We are proud to have shared our journey from 15 years ago in ‘our shoebox’ at Crowley Calvert and Associates and for the past 5 years at… -

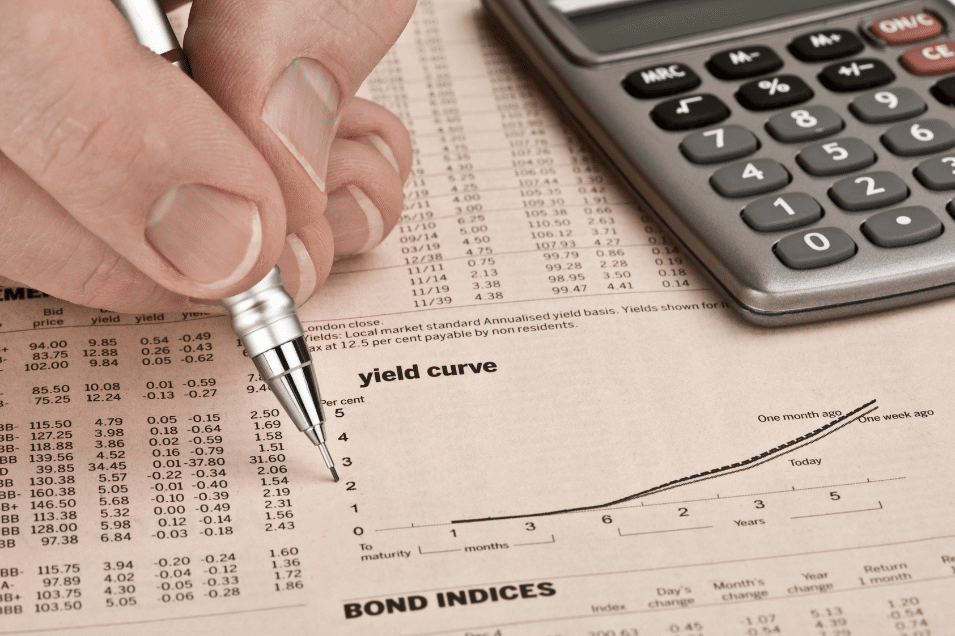

Market Movements and Economic Review | July 2024July 4, 2024Stay up to date with what’s happened in markets and the Australian economy over the past month. Despite some signs of a weakening economy with stalling growth and a softening labour market, persistently high inflation is acting as a roadblock to the RBA’s possible rate cuts. Markets have now priced in a risk that the…

-

Tax and super changes for the new financial yearJuly 1, 2024The new financial year brings a host of changes to taxes that affect all 13.6 million taxpayers.i The biggest and most high-profile change is the cuts to tax rates from 1 July, which will deliver a benefit to every taxpayer, according to the Federal Government.ii With the changes and extra income on the table it…

-

To sell or not to sell is the question for moving into aged careJuly 1, 2024Moving into residential aged care can trigger a range of emotions, particularly if it involves the sale of the family home. What is often a major financial asset, is also one that many people believe should be either kept in the family or its value preserved for future generations. Whether or not the home has…

-

Ready, Set, Goals – Is it time for a mid-year check-in?July 1, 2024Making time throughout the year to review and reassess the goals you set at the beginning of the year is just as important as setting the goals themselves. Now is the perfect time to reflect on what you’ve achieved to date and determine whether you’re still on track to achieving some or all of them…

-

Steer clear of these red flags on your returnJuly 1, 2024The Australian Taxation Office has provided a heads-up about the areas it will be focussing on when reviewing tax returns this year. The ATO says there are three common errors made by taxpayers: ATO Assistant Commissioner Rob Thomson says while the mistakes are often genuine, sometimes they are deliberate. “The ATO is focussed on supporting…

-

Deeming freeze a win for Age Pensioners | VanguardJune 10, 2024By Tony Kaye, Senior Personal Finance Writer Why the decision to keep deeming rates on hold may be a window for interest rates. In delivering the second reading of the Appropriation Bill (No. 1) 2024–25 last week, otherwise known as the latest federal budget, the Treasurer announced that the current freeze on social security deeming…

-

Investment and economic outlook, May 2024 | VanguardJune 10, 2024Vanguard has provided a region-by-region economic outlook and latest forecasts for investment returns. For the last decade-plus, a lack of both automation and new general-purpose technologies (GPTs) have weighed on U.S. economic growth. But new Vanguard research suggests that artificial intelligence (AI) will prove to be the next GPT, powering above-trend growth. Our forthcoming Megatrends…

-

Untangling yields: Lessons for income investors | VanguardJune 10, 2024By Tony Kaye, Senior Personal Finance Writer Higher interest rates equal higher yields on some investments, but not all. When the Federal Reserve Bank’s chairman, Jerome Powell, signalled last week that United States’ interest rates are likely to stay higher for longer, many income investors there would have breathed a collective sigh of relief. There…

-

Transitioning into retirement: What you should know | VanguardJune 10, 2024By Tony Kaye, Senior Personal Finance Writer Deciding on your retirement funding options comes down to personal choice. If you’re close to retirement, chances are you’ve already spent time thinking about how to tap into your superannuation when you retire. Broadly speaking, you have a few options when you retire, as long as you’ve reached…

Blog

Stay informed and up-to-date with valuable financial insights, expert analysis, and the latest news. Our blog covers a wide range of topics, from retirement planning and investment strategies to insurance updates and market trends.