ETFs

Over the past decade, the benefits of exchange-traded funds (ETFs) have resonated with millions of investors worldwide.

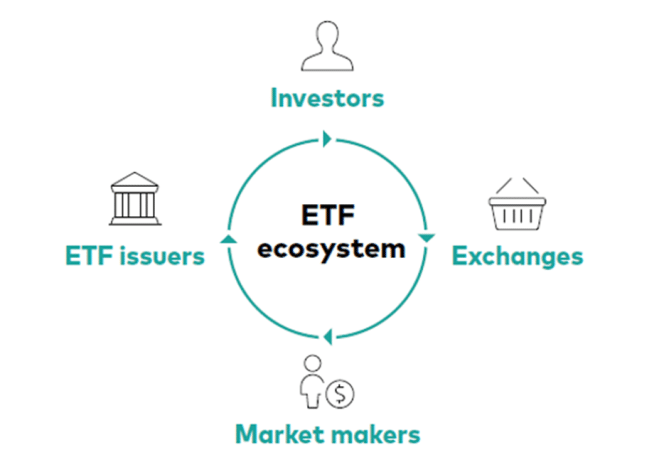

But those benefits wouldn’t be possible without the contributions of the key players within the ETF ecosystem.

While the role of the stock exchanges such as the Australian Securities Exchange (ASX) may seem self-evident, they do far more behind the scenes, subtly adding value that benefits all ETF investors.

ETFs have reshaped investing for the better, expanding investors’ access to diverse and previously unavailable strategies, lowering investment costs, and promoting tax efficiency.

Arguably, one of the paramount benefits is the liquidity and tradability that ETFs provide, offering investors an efficient trading vehicle for targeted market exposure.

Four key players are integral to bringing such liquidity to any ETF transaction. Investors place orders to buy and sell ETFs on stock exchanges. The stock exchanges create an orderly secondary market between investors and market makers. The market makers post quotes and execute investor transactions, often creating or redeeming ETF shares in the primary market with the ETF issuers.

Source: Vanguard

“Exchanges are at the heart of the ETF ecosystem, providing the necessary infrastructure for listing and trading, and ensuring ETFs meet certain criteria to be accessible to investors,” says Robert Marrocco, vice president and global head of ETF listings at Cboe Global Markets.

Stock exchanges essentially represent the “E” in ETFs, adds Douglas Yones, head of exchange traded products at the New York Stock Exchange. “Our role is to ensure our listed ETFs are traded in a highly liquid market with exceptional price transparency, so that investors can enter and exit their investments as easily as possible.”

But stock exchanges also do far more behind the scenes beyond being a listing venue, says Alison Doyle, head of ETF listings at the New York-based Nasdaq stock exchange. Just for example, she says, they “can help connect issuers with market makers who are most proficient in certain asset classes and would be best suited to support their product.”

How better liquidity translates to investor cost savings

Near-perfect liquidity in trading — low costs; narrow bid-ask spreads; tight alignment between market price and net asset value (NAV); and instant, seamless execution — is the holy grail that all players in the ETF ecosystem strive for.

Stock exchanges offer a variety of programs and incentives for market makers to maximise the liquidity of all the ETFs listed on their exchange. For example, there are incentives for designated and lead market makers to meet certain requirements, including the quality of auctions, trading depth, and time with the best bids and offers. They also strive to attract more market-making firms to provide liquidity to ETFs.

Every stock exchange also has programs unique to it. Collectively, the goal of these programs is to create a deep, liquid, and tightly traded market for the ETFs listed on their share markets — all to the benefit of end investors.

The past, present, and future of ETFs

Stock exchanges have seen rapid growth in both the quantity and variety of ETFs — a trend that’s not likely to slow down.

“ETF trading has grown to be a substantial percentage of the daily trading in the equity market,” says Doyle, adding that ETFs are proving to be the vehicle of choice both for strategic long-term investments as well as for tactical trading during times of volatility.

“This year is already shaping up to be an exciting time for the industry as new innovative products come to market and drive growth,” says Marrocco. “More investors are looking towards derivatives-based and defined-outcome ETFs, so we expect to see more interest from issuers to find the right strategy.”

Other innovations may be conversions of existing strategies into a new form.

For example, Yones says, “we anticipate that actively managed ETFs and access to new investment styles within an ETF wrapper will continue to remain growth areas over the next decade.

“Today, investors have more access, more strategies in an ETF wrapper, and more opportunities for ETF education than ever before as we continue to invest in the growth and innovation of the ETF marketplace.”

Important information and general advice warning

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (“Vanguard”) is the issuer of the Vanguard® Australian ETFs. Vanguard ETFs will only be issued to Authorised Participants. That is, persons who have entered into an Authorised Participant Agreement with Vanguard (“Eligible Investors”). Retail investors can transact in Vanguard ETFs through Vanguard Personal Investor, a stockbroker or financial adviser on the secondary market.

We have not taken your objectives, financial situation or needs into account when preparing this publication so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for Vanguard’s products before making any investment decision. Before you make any financial decision regarding Vanguard’s products you should seek professional advice from a suitably qualified adviser. The Target Market Determination (TMD) for Vanguard’s ETFs include a description of who the ETF is appropriate for. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. You can access our IDPS Guide, PDSs Prospectus and TMD at vanguard.com.au or by calling 1300 655 101.

Any investment is subject to investment and other known and unknown risks, some of which are beyond the control of VIA, including possible delays in repayment and loss of income and principal invested. Please see the risks section of the PDS for the relevant VIA product for further details.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.