Here is a sneak peek into the diary of Hugh Robertson, Managing Director and Principal Financial Adviser at Centaur Financial Services, as he joins the Inside Network on their USA Study Tour 2024.

We were fortunate to be one of only two Queensland firms to attend the inaugural Inside Network USA Study Tour 2024. We are always looking for the best strategies and ideas, and the advice firms invited on this trip were considered best of breed.

This tour was the first of two for me and started in Boston. I have set out a bit of a diary of what we did below.

Sunday 8th September 2024

Arrived in Boston after a long flight from Brisbane to LA, LA to Boston. Had to try a Lobster roll upon arrival, and then off for a tour to learn the history of Boston, the birthplace of America.

That night we had an introduction from an investment strategy that looks for MIT and Harvard PhD students ideas and how to commercialise these. Some of these will return 100x on the investment, some will not make a dollar.

The first speaker was Alex Creely, a director of Commonwealth Fusion Systems (CFS). CFS is a fusion power company founded in 2018 in Cambridge, Massachusetts, after a spin-off from MIT. CFS aims to build a small fusion power plant based on the ARC (affordable, robust, compact) tokamak (a magnetic-field confinement device being developed to produce controlled thermo-nuclear fusion power) design.

The second speaker was Ramin Hasani, CEO and Co-Founder of Liquid AI. An MIT spinoff, Liquid AI was founded by a quartet of MIT Computer Science and Artificial Intelligence Laboratory (CSAIL) AI and machine learning scientists, to forge the future of AI with enterprise-grade foundation models that are capable, private, and reliable. Liquid AI aims to build best-in-class, domain-specific, and general-purpose AI systems powered by liquid foundation models (LFMs).

There were many other PhD’s in the room and I definitely felt inspired in the future of the world listening to these guys discuss what they are working on. So please don’t give up on society.

Monday 9th September

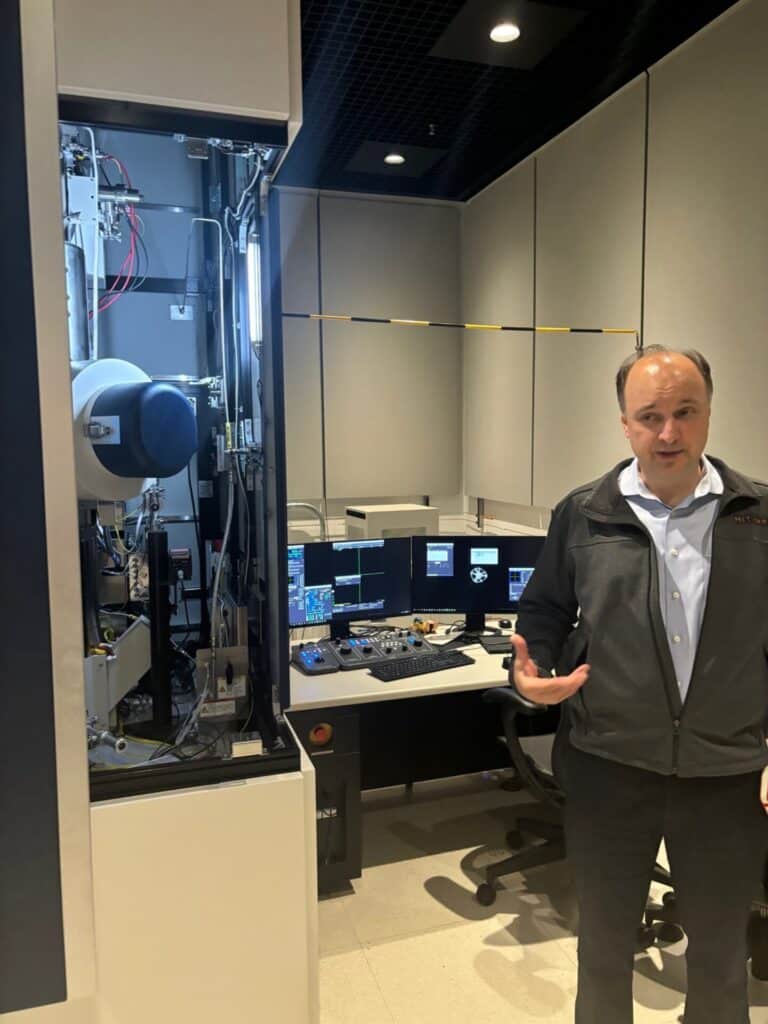

We completed a tour of MIT and Harvard. At MIT we got to go into the classrooms and meet Vladimir Bulović, the Dean for Innovation, who runs the Nano lab, a 2 billion dollar facility. After this, we went off to Harvard for a tour of the school, and to meet Connor Walsh, who is developing robotics into materials.

Between these 2 educational institutions, you definitely feel the power of information and the application of knowledge. These universities help their students commercialise their Ideas and from there will also receive royalties and shareholdings for helping facilitate the inventions and innovations that successfully commercialise.

MIT

Harvard

I left there wishing that Australian universities followed this model, although I was then reminded that these are two of the best universities in the world, and that is a reason why.

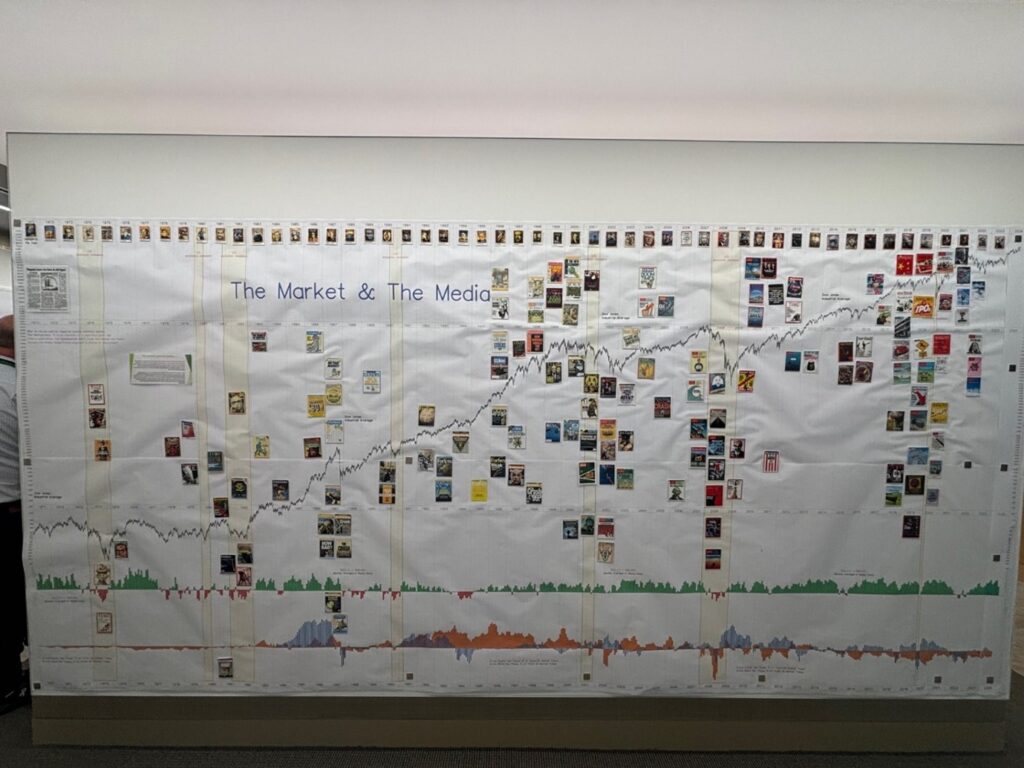

We then went to Fidelity to visit their Chart Room and their Innovation Centre. I got to be a nerd and enjoy the Chart Room and the history of the markets. The lesson is that markets always go up despite whatever the current noise is.

Fidelity Chart Room

That night we then got to go to watch the Boston Redsox play the Baltimore Orioles at Fenway Park. As a kid I played baseball so this was pretty cool to watch a ball game at a revered stadium.

Tuesday 10th September

We stayed in the hotel and had half a dozen sessions ranging from practice management sharing, insights from the US advice model, the value of data investing, the end of the world and what comes after that, and the advice firm of the future.

There was a lot of content to get through and it really reinforced in my mind that service is one of Centaur’s key differentiators as well as our ability to ignore the noise when it comes to investing.

From here we left for a train to The Big Apple, New York City.

Wednesday 11th September

This day was one for the memory bank. From an investment perspective, we met with Collar Capital, which is the biggest provider of secondaries in the world. We also met with Ares who is the biggest private credit lender in the world, and then we went to a closing of the bell at the New York Stock Exchange.

To get in there is difficult in its own right, but to be there on a closing bell was unforgettable. We then had a historian give the history of the US share market – it was fascinating and if I can I will get the historian to do a podcast with us one day.

For me, this was a dream come true. Ever since university, I wanted to go to Wall Street, to feel the energy and acknowledge the history of the markets. It was truly humbling and inspiring and reinforced me to always stay optimistic. It was a great reminder that markets continue to grow, always.

It was strange to end the day with the memorial for 9/11. I can only equate the feeling to how, as Aussies, it feels to go to Gallipoli. It was gut-wrenching to see all of the people, especially Americans crying and remembering such a tragic day. It is surreal to have met some people who were there when the attack happened, and how they recounted the sounds and aftermath. You cannot imagine it happening in Brisbane or Sydney.

Thursday 12th September

We visited JP Morgan and talked about the future of investing, they showed us what they are doing with AI – did you know they spend $500 million per year on AI alone – you struggle to think any Australian company can afford such a spend. We also looked at their global transport fund – sounds different – but effectively they lease transport vehicles to companies and in return get a high coupon. And it doesn’t have share market volatility. Which means it works to smooth out returns in a diversified portfolio.

We then went to Warburg Pincus, one of the oldest private equity firms in America. They hosted a political lunch with an ex-Clinton staffer, Jake Siewart, who provided many stories of what happens in Washington DC.

That afternoon we went to Kayne Anderson over in Brooklyn (after some navigating of the subway system). It was interesting to hear about their investment capabilities and they are going to try and build out their private credit capabilities in Australia. We then had dinner on the rooftop of one of their buildings before a walk home over the Brooklyn Bridge.

Friday 13th September

Alpha summit. We had presentations around finding alpha in public markets, the allure of alternative alpha, the US practice of today, honing private equity exposures, the once-in-a-lifetime investment opportunity, the liquid alpha revolution and capped off by a keynote address by former prime minister Kevin Rudd.

Fascinating to hear Rudd’s views on the US–China Tensions, as he was a self-confessed China bull and has now changed his tune. I got to speak with him for about 20 minutes after his keynote and I must admit I left thinking he wasn’t a bad person (no matter what your political view of him is.)

This was the first of two invite-only events I was fortunate enough to attend. The key takeouts for me were that the future is in good hands, don’t give up on America (despite their political craziness), there are some great investment strategies out there we need to pursue for our clients, and financial advice businesses need to ensure they are always growing so they stay up to date with the latest strategies out there.

Be sure to check out my next blog entry – Barron’s USA Top Advisor Summit 2024