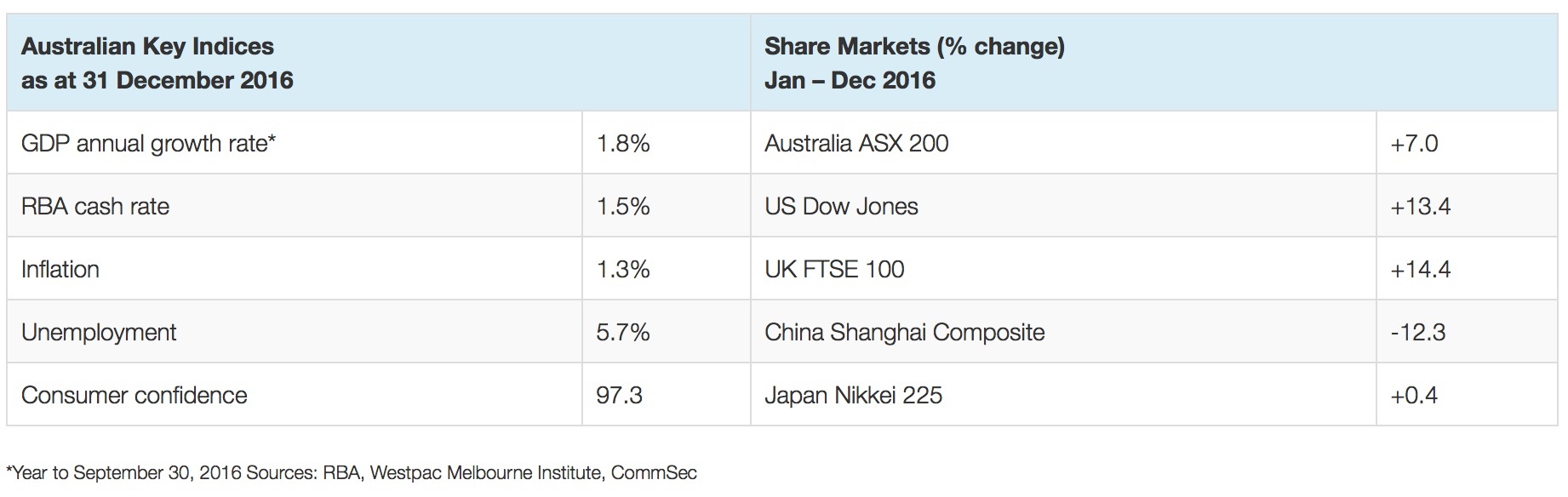

If 2016 taught us anything, it was to expect the unexpected. Britain’s vote to exit the European Union and Donald Trump’s election as the next US President surprised the pundits and markets alike. Markets generally hate surprises, yet in the closing weeks of the year so-called ‘Trump trades’ pushed shares, bond yields and the US dollar.

Then, in a not-so-surprising move, the US Federal Reserve lifted rates for only the second time since 2006. At its December meeting, the US Fed lifted rates to a range of 0.5 to 0.75 per cent and forecast three more rises in 2017. This was viewed as a vote of confidence in the US economic recovery and a signal that the global economic tide may be turning.

Economy poised for growth

The Federal Reserve board forecasts US economic growth of 2.1 per cent in 2017 and unemployment of 4.6 per cent. In Australia, the medium-term outlook is also positive but there were hiccups along the way in 2016.

Uncertainty surrounding the US election, Brexit and our own mid-year federal election weighed heavily on the local economy, which shrank 0.5 per cent in the September quarter. This was the first negative quarter since March 2011 and lowered the annual growth rate from 3.1 per cent to 1.8 per cent.

The Reserve Bank has warned that the economy could slow further before picking up in 2017.i Our trade performance is moving in the right direction though, thanks to higher commodity prices and the lower dollar. Australia’s trade balance moved back to surplus in November for the first time in 33 months; the rolling 12-month deficit of $23.8 billion was the lowest in 18 months. What’s more, the unemployment rate, at 5.7 per cent, remains near three year lows.

Commodities rebound

One of the big turnarounds of 2016 was the surge in commodity prices. Iron ore almost doubled in price to $80 a tonne. Other metals were also up strongly, along with agricultural commodities and oil. Crude oil rose 45 per cent to US$53.72 a barrel as OPEC and non-OPEC nations agreed to cut oil production.

While more expensive fuel is bad news for motorists, higher commodity prices are a boon for Australia’s mining and agricultural sectors. As these higher prices flow through to inflation they should help pave the way for central banks to lift interest rates to more normal settings. Inflation in Australia is running at an annual rate of 1.3 per cent, well below the Reserve Bank’s target band of 2-3 per cent.

Interest rates on the rise

Australia’s cash rate remains at 1.5 per cent but there are signs that we may have reached the bottom of the rate cycle. The major banks have already begun lifting home loan rates and this trend looks set to continue as mortgage funding sourced from overseas becomes more expensive.

Donald Trump’s election victory also marked a turning point in bond yields on the expectation that his policies will be stimulatory. US 10-year bond yields rose slightly to 2.45 per cent in 2016, while Australian 10-year government bond yields lifted to 2.79 per cent after reaching an all-time low of 1.83 per cent in August.

The US dollar has also strengthened against the Aussie dollar, which finished the year at US72.36c after hitting a high of US78c in November.

Shares finish strongly

Global sharemarkets reacted positively to Trump’s promised tax cuts and infrastructure spending. After negative returns in 2015, the US market finished the year up 13.4 per cent and Australian shares rose 7 per cent led by the resources sector.

Despite the solid gains in shares and residential property, Aussie consumers finished the year in a sober mood. The Westpac-Melbourne Institute Index of Consumer Sentiment eased to 97.3 in December, down 3.5 per cent over 12 months. By comparison, business confidence is improving. The NAB Business Confidence Index rose from 4.3 points to 5.0 points in November.

Patchwork property market

The residential property market continues to grow, but it was a tale of many markets. Home prices grew 10.9 across all capital cities, but a modest 2.8 per cent outside the metropolitan areas. Sydney prices rose 15.5 per cent, followed by Melbourne (13.7), Hobart (11.2), Canberra (9.3), Adelaide (4.2), Brisbane (3.6) and Darwin (0.9). Perth prices fell 4.3 per cent.ii

Although housing affordability remains a national issue, the property market shows no signs of a hard landing.

Looking ahead

The prospect of higher interest rates and inflation, after almost a decade of abnormally low rates, marks a turning point for global financial markets. There are bound to be setbacks along the way, as the world weans itself off cheap credit, but the gradual recovery in global economic growth is just what the central bank doctors ordered.

If you would like to discuss the contents of this article in the context of your overall investment strategy, don’t hesitate to call. Whether you live on the Gold Coast, Brisbane, Sydney, or Melbourne, our financial advisors can help.

i Statement by Philip Lowe, Governor: Monetary Policy Decision, RBA, 6 December 2016, https://www.rba.gov.au/media-releases/2016/mr-16-30.html

ii Core Logic Home Value Index, http://www.corelogic.com.au/news/capital-city-dwelling-values-surge-10-9-higher-over-the-2016-calendar-year/