Most of us dream of the day we can stop working and start ticking off our bucket list. Whether you dream of cruising Alaska, watching the sun rise over Uluru, improving your golf handicap or spending time with the grandkids, superannuation is likely to be a major source of your retirement income.

The more money you squirrel away in super during your working years, the rosier your retirement options will be. The question is, how much is enough?

The super retirement balance you need to aim for will depend on a number of factors including the age you retire, how long you live, the lifestyle you wish to maintain, future health and aged care costs and whether you receive a full or part Age Pension.

You also need to factor in whether you own your own home outright and your relationship status because two is generally cheaper than one.

Estimating your needs

Financial commentators often suggest you will need around two thirds (67 per cent) of your pre-retirement salary to enjoy a similar standard of living in retirement.i Lower income households may need more because they typically spend more of their income on necessities before and after retirement.

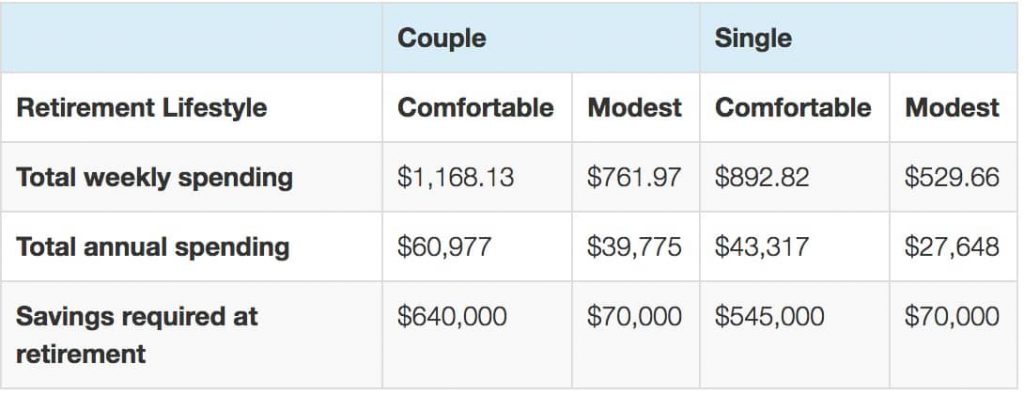

The latest ASFA Retirement Standard estimates that a couple retiring today needs a retirement super balance of $640,000 to provide a comfortable standard of living. As the table below shows, this would provide an annual income of $60,977.ii

Singles need a lump sum of $545,000 to provide a comfortable income of $43,317 a year. These figures assume people own their home and include any entitlements to a full or part Age Pension.

Source: ASFA Retirement Standard December quarter 2018

Of course, everyone’s idea of comfort is different. Annual overseas trips or expensive hobbies may require higher savings. Frugal homebodies may get by with less, while those with health issues may require more.

How do I compare?

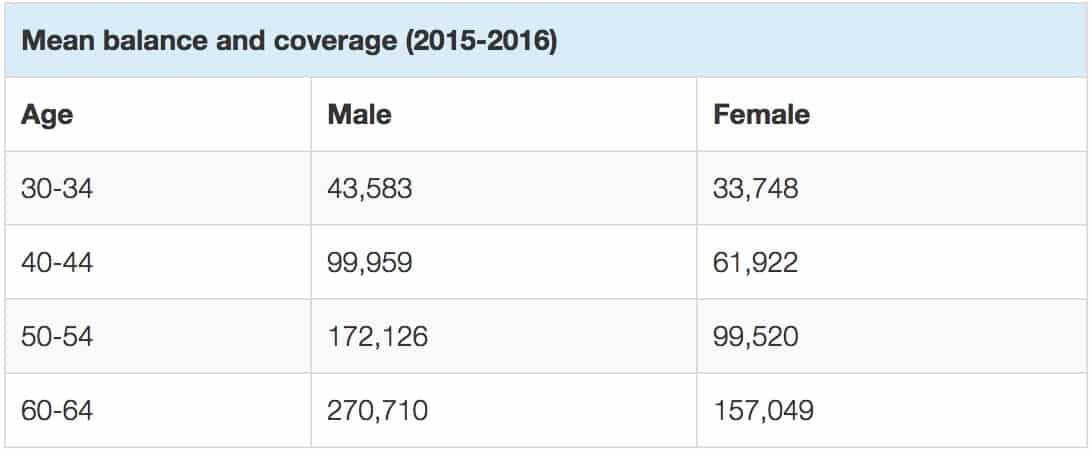

The mean balance at retirement (age 60-64) shows most people retiring today fall well short of the amount needed for a ‘comfortable’ retirement.iii

Since these figures were taken most people will have increased their balance, but the gap between men and women persists at all ages. Women are more likely to take time out of the workforce, earn less than their male counterparts and work part-time. Divorce also tends to put a bigger dent in women’s retirement savings. By the time women reach their 60s they have 42 per cent less super than men on average and are more likely than younger women to have no super at all.

Source: ABS, ASFA

How can I boost my super?

If your super is not tracking as well as you would like, there are ways to give it a kick along.

When your budget allows, or you receive a windfall, consider putting a little extra in super. Even better, set up a direct debit or salary sacrifice arrangement.

-

- You may be able to make a tax-deductible contribution up to the $25,000 annual concessional cap but be aware that this cap includes employer contributions and salary sacrifice.

-

- You may also be able to contribute up to $100,000 a year after tax, or $300,000 in any three-year period. You can’t claim it as a tax deduction, but earnings will be taxed at the maximum super rate of 15 per cent rather than your marginal rate and you can withdraw the money tax-Complimentary from age 60. Your age and the amount you have in super can restrict the amount of contribution caps.

-

- If you earn less than $37,000, your other half can contribute to your super and claim a tax offset of up to $540. The offset phases out once you earn $40,000 or more. This tax offset is open to married, de facto and same sex couples.

-

- If you are a mid to low income earner and make an after-tax contribution to your super account, the government will chip in up to $500. To receive the maximum contribution, you need to earn less than $37,697 and contribute at least $1,000 during the financial year. The government co-contribution reduces the more you earn and phases out once you earn $52,697.

-

- Speak with your employer about directing some of your pre-tax salary into super. ‘Salary sacrifice’ contributions are taxed at a maximum of 15 per cent (30 per cent if you earn over $250,000). But stay within your concessional contributions cap of $25,000 a year, which includes employer contributions.

-

- If you are 65 or older you may be able to make a downsizer contribution to your super of up to $300,000 from the proceeds of selling your home. Couples could contribute up to $600,000. This is not a concessional or non-concessional contribution and does not count towards your contribution caps. The property must have been owned for at least 10 years and used as the main residence for some or all the time. It can only be used once, it’s not tax deductible and may impact your Centrelink entitlements.

To work out the difference extra contributions could make to your retirement nest egg, try out the MoneySmart retirement planner calculator.

As the end of the financial year approaches and with the federal election looming, this is a great time to utilise your annual contribution caps and get a tax deduction for voluntary concessional contributions. If you would like to talk about your retirement income strategy, give us a call.

i Moneysmart, Last updates 27 Aug 2018, https://www.moneysmart.gov.au/superannuation-and-retirement/how-super-works/super-contributions/how-much-is-enough

ii ASFA Retirement Standard, 1 December 2018, https://www.superannuation.asn.au/resources/retirement-standard

iii Superannuation Statistics, March 2019, ASFA, https://www.superannuation.asn.au/ArticleDocuments/269/SuperStats-Mar2019.pdf.aspx?Embed=Y