Here is a sneak peek into the diary of Hugh Robertson, Managing Director and Principal Financial Adviser at Centaur Financial Services, as he joins the invitation-only Barron’s USA Top Advisor Summit.

Leaving one great trip (The Inside Networks USA Study Tour) and embarking on another is tough. I missed my family tremendously, and my brain was fatigued, but my beautiful wife Jo supported me in doing part two as you never know when these opportunities are ever going to come your way again. We were one of the only Gold Coast businesses that went to either of these events, let alone both. And we feel this gives us better insights to give you better advice and investment outcomes.

In 2023 I was the highest-ranked individual adviser on the Gold Coast, and the USA advisers revere the Barron’s Top Advisor rankings over there yet we don’t really promote it much over here.

16th September 2024

The Barron’s tour started with a meeting at Rupert Murdoch’s Headquarters. We got an update from the Barron’s team on trends happening in financial advice in America. From there we had three of their top advisers present to us – Adam Epstein, Liz Weikes, and Angela Raitzin.

We received amazing insights from the three advisers. They were very kind and generous with sharing of their knowledge, how they run their teams, how they invest clients’ money, and how they continue to grow.

Then we went off to meet with an Aussie who now lives in America, Hugh Jackman. No, just kidding… just seeing if you are still reading. We met with Jamie Dunham of William Blair and Co. This was another trip of Q&A’s about the US industry and what trends are from his viewpoint from investment banking, private wealth and investment strategies. I’ve attached a picture of a local Gold Coast legend too, with Grant Hackett (just kidding).

17th September 2024

We went and saw BlackRock and discussed the evolving wealth ecosystem including global, industry and portfolio trends. They presented on the financial adviser of the future with a focus on the generational wealth transfer.

We then went to see Benefit Street Partners to talk about private credit and then BSP Alcentra to understand Collateralised Loan Obligations. From there we went to see Lexington Partners to discuss their private equities and secondaries capabilities. The brain was truly fried after these afternoon sessions.

18th September 2024

We left for West Palm Beach for the Barron’s Top Adviser conference. That night we heard from Pulitzer Prize-winning historian John Meacham discuss the 2024 election. Fascinating to hear his views and to learn US Presidential history.

19th September 2024

The conference started at 7am with breakfast with Drew Freides of UBS Century City, one of the largest financial advice firms in LA. We then had a presentation by Dr David Kelly about the US and global economy and key takeaways. We then had a ‘fireside chat’ with Merrill Lynch presidents Lindsay Hans and Eric Schimpf.

A key to Centaur’s success is our team so I went to the driving performance presentation about aligning compensation with team collaboration. I then sat through navigating the future: asset management insights, market perspectives and portfolio strategies which really focused on how to get outsized returns in the current market. Then there were executive insights into private markets which had the South Carolina Pension Fund discuss how they allocate their capital to protect their members and how they use private credit.

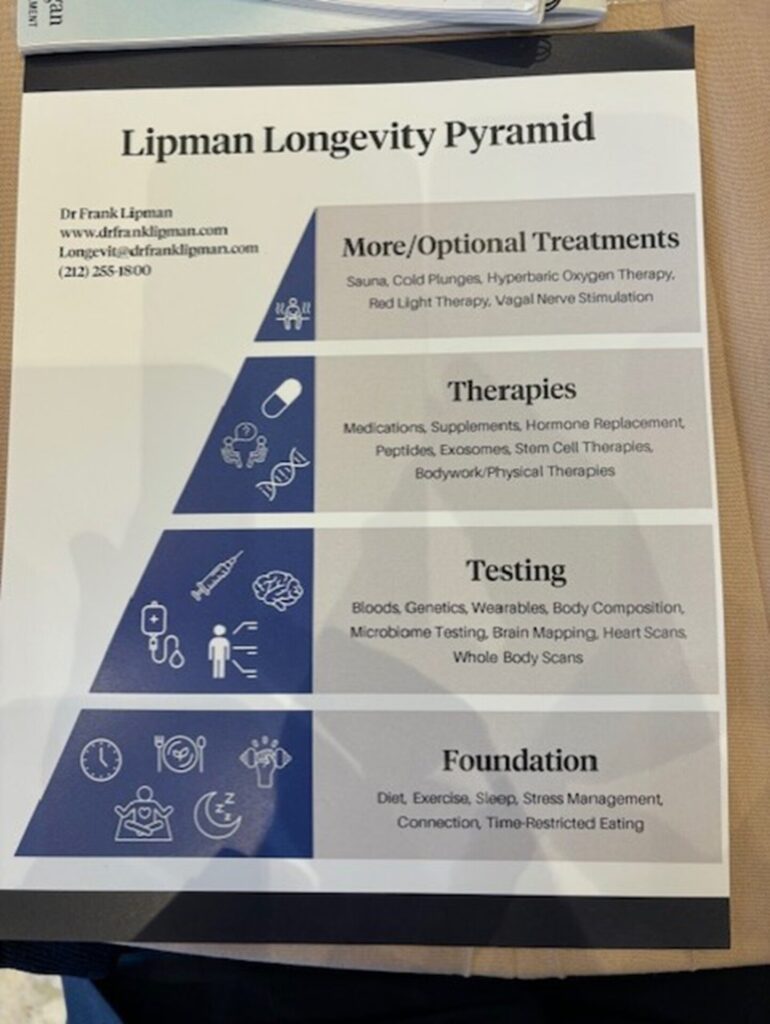

After that, there was a session on how to build your practice so it can scale effortlessly. That led to creating a compensation plan to drive growth and accountability. The day finished with a fascinating talk from Dr Frank Liman on living healthier, and longer. I thoroughly recommend his book and his tips are attached in the picture.

20th September 2024

We had 7 am start again with Kevin Myeroff who grew one of the biggest firms in Ohio about how to grow a business and take care of your team. We then had Ray Scalfini come and talk to us about the trends in the independent financial adviser space in USA and similarities to Australia. Ray was a walking encyclopedia of what successful financial advice practices do.

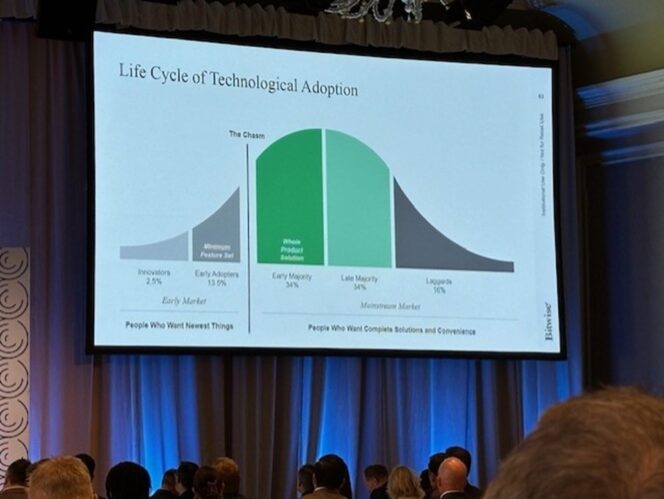

Today started with a session on crypto, in particular Bitcoin. Although not on our radar it is always something we should listen to so that we have an informed opinion on it. We then heard from Dennis Moseley – Williams which was a transformative session on redesigning from a service-based firm to both a service and experience-based firm.

23rd September 2024

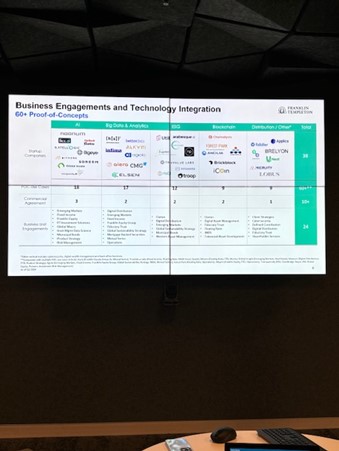

We went to Franklin Templeton HQ in San Mateo (near Silicon Valley). We had the chief market strategist Stephen Dover present to us what their view of the markets is. Views are that markets will broaden, commercial property could start performing again, alternative investments warrant looking at, emerging markets should be a beneficiary of a global soft landing.

Elsa Goldberg, senior VP of Templeton Global Macro discussed global interest rates and where the opportunities lie in the fixed interest space, FYI Kazakhstan government bonds yield are currently 13.569% for 1 year. We will avoid this investment.

Richard Herbert spoke to us about the opportunities in mid and late stage private companies. This was a fascinating insight into how they find investments and execute them. With an increasing number of companies staying private (and not going onto the share market), there is a larger pool of opportunities in this space.

After this we went to see the FinTech Incubator Lab with Margaret King, the senior vice president of digital strategy and wealth management. After that we had lunch with Billionaire Greg Johnson, a majority owner of Franklin Templeton (and the San Francisco Giants) on what he see’s happening in the future of advice.

We spent the afternoon touring San Franciso sights like the Golden Gate Bridge and drove down Lombard Street.

24th September 2024

This was the final day of what was a long and rewarding trip. We met with Chris Hauswirth from Laird Norton Wetherby who talked about their business, the challenges and the opportunities. After this we met with Tom Palecek of Summit Trail Advisers. He spoke about how they have grown to be a $20 billion dollar firm and the challenges of growth while staying focused on your clients.

Getting driven around in driverless cars felt like we were in space age. Completely surreal experience.

My key take outs from the trip

- We need to ensure we are always building the business around our clients and building services that you need

- As a firm we are only as good as our people. We need to ensure we always have a great team and culture

- There are investments advisers are using in the USA that we should consider using for our clients here

- Succession planning and growing the team is important. With growth comes the ability to get better outcomes for clients.

If you haven’t already, be sure to check out part one of my trip to the USA with the Inside Network USA Study Tour 2024 blog