Market Review

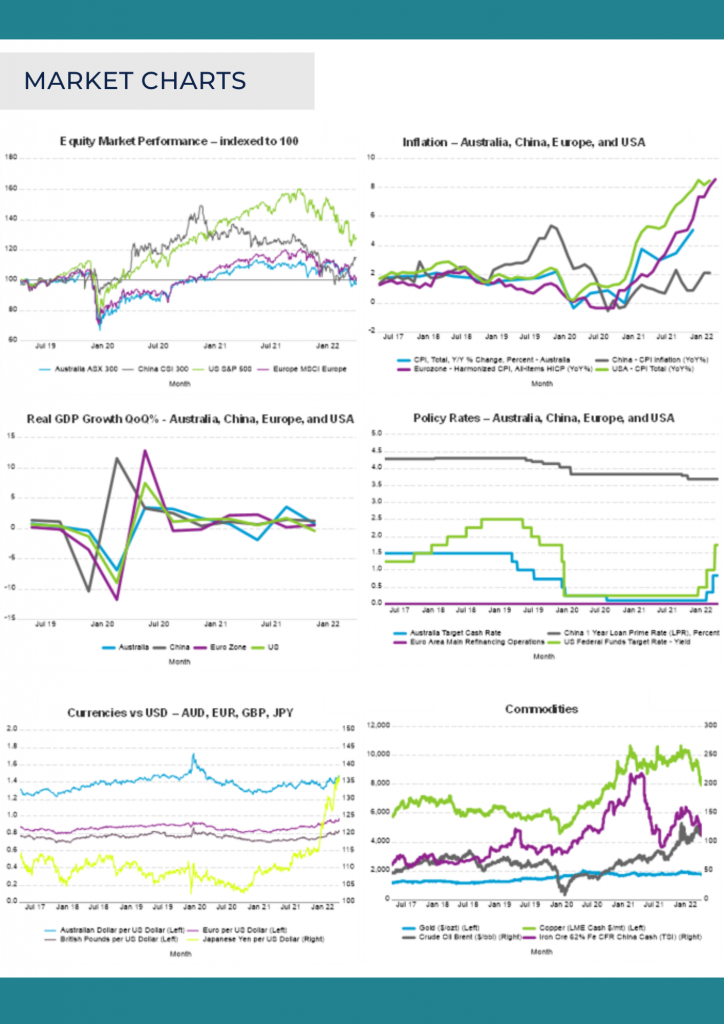

To cap off an eventful second half of the 2022 financial year, we saw dire global economic and market headwinds not seen since the GFC over a decade ago. With the US, the largest economy in the world teetering on falling into a ‘hard’ or ‘soft’ landing recession, we also saw its share market post its worst start to a calendar year in over half a century.

Investors holding traditional defensive assets, in the form of long maturity bonds, have also felt the pain of large negative returns over the year – something not seen for over 30 years.

Global Inflation and Interest Rates

Over June, discussions continued over the prospect of a recession in the US, as pessimism over global growth and rising inflation rocked financial markets.

The World Bank warned that the “war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid” and that the “danger of stagflation is considerable”. High inflation is eroding the purchasing power of households, underpinning a sharp deterioration in consumer confidence around the world. In response, Central banks are hiking rates aggressively to rein in inflation – but must walk a delicate tight rope. There is a risk that central banks may overtighten and drive a contraction in economic activity in their efforts to combat inflation.

Uncertainty is elevated, particularly given the complex and unprecedented supply-side disruptions which are a major driver of inflation. It remains unclear how quickly these disruptions will ease. As such, the risk of a policy mistake is elevated against this backdrop.

On the back of inflation in the US hitting a 40-year high of 8.6% over the year to May, the US Federal Reserve (Fed) hiked the federal funds rate by 75bps on 15th June to a range of 1.50% to 1.75%. The hike was the largest since 1994, reflecting the extent of inflation concerns amongst policymakers. The move followed the hotter-than-expected consumer price index reading in May, which showed inflation hit 8.6%, its highest level since 1981.

Locally, the minutes from the Reserve Bank of Australia’s (RBA) June meeting revealed that the Board debated hiking by 25 or 50bps (they went with 50bps at their meeting on the 7th of June). With inflation elevated and set to accelerate to around 7% per annum by later this year, it is difficult to see the RBA deviating from its task over the coming months in going harder to tame inflation. Looking ahead, if the RBA slows the pace of back-to-back tightening at 50bps per month from July onwards, it could pressure the Australian dollar lower against the currencies of other economies, therefore delivering higher ‘imported’ inflation at a time when inflationary pressures are still building.

Faster and larger rate hikes could help tame inflation and wage expectations, which feed heavily into actual inflation. However, inflationary pressures coming from supply-side disruptions, including the war in Ukraine and China’s zero-covid strategy, are unlikely to wane significantly in the near term. The growing risk for Australia and for other major central banks is that withdrawing stimulus (Quantitative Easing) and/or by raising rates too quickly could overly accelerate a slowdown in growth whilst not bringing inflation down sufficiently. Therefore, concerns around downturns and recessions are emerging in other major economies where the tightening cycle is more advanced.

Central banks will continue to have their work cut out for them over the rest of 2022 and beyond as they seek to manage inflation and growth concerns.

The World Bank slashed its forecast of global GDP growth this year from 4.1% to 2.9% and stated that the world should prepare for “several years of above average inflation and below average growth“.

Developments in the Global Economy

Australia

June saw the release of NAB’s Business Confidence and Conditions surveys that saw a decline in business confidence of 4 index points to +6 in May. A range of factors are weighing on confidence among businesses, including elevated inflationary pressures, labour shortages, and supply-chain disruptions. The fall in consumer sentiment and increases in interest rates from the RBA are also likely weighing on business confidence. The prospect of continued pressure on global supply chains as China implements its zero-COVID policy, and the risk of a slowdown in global economic growth alongside central bank policy tightening, may impact confidence in the months ahead.

Business conditions fell to +16 from a revised +19 in April. However, conditions remain elevated and well above the long-run average of +7. The decline reflected a fall in the profitability and trading sub-indices. However, while both sub-indices pulled back from recent 10-month highs, they remain elevated and were at their second highest level in 11 months. Profitability and trading conditions had been improving over much of 2022 as restrictions across the country lifted and consumers adapted to living with COVID.

Employment conditions improved slightly over the month to be more than five times higher than the long-run average. Labour demand is strong, and the job market has become increasingly tight as the economy recovers. Businesses are finding it more difficult to find the right kind of labour as slack across the job market is absorbed. Reports of skills shortages are widespread with the unemployment rate falling to a near 48-year low of 3.9%, and as such, wage pressures are building.

Despite a range of challenges, business conditions and confidence have remained resilient, as leading indicators point to continued economic momentum in the near term. Business investment is also likely to be supported by generous tax incentives which remain in place until June 2023.

Dwelling prices declined for the second consecutive month, dropping by 0.6% in June following a 0.1% decline in May. The falls come after the RBA’s interest rate hikes over May and June. Momentum in the housing market has continued to slow since the monthly 2.8% peak of growth in March 2021. June’s 0.6% drop was the largest monthly decline since July 2020, when dwelling prices fell for several months early in the pandemic. The fall in June was driven by decreases in Sydney (-1.6%) and Melbourne (-1.1%). Prices have declined for five consecutive months in Sydney, and the drop in June was the largest monthly fall since December 2018. In Melbourne, prices have declined for four of the past seven months. The June fall was the largest since August 2020.

Higher levels of supply continue to contribute to price declines in Sydney and Melbourne. Listings across the two cities are around 7% above levels seen a year ago and well-above their respective five-year averages. However, it should be noted that the increase in supply reflects a decline in sales volumes rather than an increase in new listings – this is reflected by a decline in the sales volumes to new listings ratio. The softening in housing market activity is also reflected by a fall in auction clearance rates. With more tightening to come from the RBA this year, and possibly into early next year, dwelling prices are set to slide further, and the price declines broaden out across capital cities and regional areas.

In annual terms, dwelling prices rose 11.2% over the year to June, which is the slowest rate of annual growth since May 2021. The annual growth rate continues to decline as the earlier months with high rates of growth drop out of the annual growth calculation.

Retail sales climbed 0.9% in May to a new record high, marking the fifth consecutive month of growth. Sales were 10.4% higher over the year, the strongest annual growth since April 2021. This is despite growing headwinds for consumers. Household budgets are being squeezed by red-hot inflation which has run well ahead of wages growth, as well as the fact that interest rates are also rising. The retails sales result was stronger than projected by consensus forecasts, and suggests consumer spending, so far, has been more resilient than expected. Retail sales have increased in 8 of the past 9 months and are now 23.3% higher than their pre-pandemic level in December 2019.

The ongoing strength of retail sales is in notable contrast to consumer sentiment, which paints a clear picture that households are feeling particularly pessimistic. In fact, sentiment hit a 22-month low in June, not far above the levels it reached in the dark, early days of the pandemic. At that time, there were credible fears that our health system would be overwhelmed, and the unemployment rate would hit double digits. Sentiment is also nearing levels last seen during previous crises, such as the GFC and the early 1990s recession.

United States

As mentioned above, during June the US Fed hiked the federal funds rate by 75bps to a range of 1.50% to 1.75%. The hike was the largest since 1994, reflecting the extent of inflation concerns amongst policymakers. The move followed the hotter-than-expected consumer price index reading in May, which showed inflation hitting its highest level since 1981.

Further aggressive hikes from the Fed are on the cards. Fed Chair Powell has emphasised that the central bank is “acutely focused on returning inflation to our 2% objective”. There is a long way to go to get inflation back to the target and another 75bps hike in July is certainly a possibility. Indeed, some Fed officials have voiced their support for another 75bps increase next month. Interest-rate markets are currently priced for the fed funds rate to be 70bps higher at the July meeting, with expectations of another 200bps of tightening over the rest of the year.

Inevitably, higher interest rates will slow economic growth. The key question is, will it be a soft landing? In other words, can the Fed steer a slowdown in growth while avoiding a recession and normalising inflation? A US recession would cause a slowdown in global growth, which in turn would lower demand for Australian exports. It would also lower investors’ willingness to take risk, resulting in tighter global financial conditions.

ASIA

In late June, the Chinese government announced that its pandemic-led quarantine and test requirements for COVID are to be adjusted to a more ‘relaxed’ mode. Some cities have already relaxed testing frequency and reopened schools and restaurants. The government announcement covers the whole country, suggesting that the latest COVID peak has passed, which hit a positive note for the market. Regardless, this relaxed stance will see the GDP target of 5.5% for 2022 being achieved.

China’s annual inflation rate was at 2.1% in May 2022, unchanged from April’s 5-month high figure and comparable with market forecasts of 2.2%. Prices of food rose the most since September 2020, up for the second straight month (2.3% vs 1.9% in April) as consumption strengthened following an easing of the COVID-19 restrictions.

The Caixin China General Manufacturing PMI climbed to 51.7 in June 2022 from 48.1 in May, topping market forecasts of 50.1. The latest figure marked the first expansion in factory activity since February and the steepest pace since May 2021, again attributed to the easing of COVID-19 lockdowns. Both new orders and foreign sales returned to expansion, and buying activity rose modestly.

Meanwhile, employment fell for the third month in a row on the back of a renewed fall in backlogs of work. Delivery times shortened for the first time in 2 years as logistics issues eased. In the meantime, confidence was at a 4-month high in an anticipation of further increases in output and demand as infections recede.

Japan’s retail sales rose 3.6% year-on-year in May (vs 4.0% market consensus), and the previous month’s data was revised up to 3.1% (vs 2.9% preliminary). Retail sales have risen now for three months in a row.

The Bank of Japan’s index for large manufacturers’ sentiment fell to 9 in the second quarter of 2022 from 14 in the previous quarter, hit by rising input costs and supply disruptions caused by the war in Ukraine and China’s strict COVID-19 lockdowns.

This latest figure also came in below the expectations for a reading of 13 and is the lowest since March 2021. The mood softened mainly among firms producing ships and heavy machinery (-19), motor vehicles (-19), food & beverages (-11), textiles (-10), pulp & paper (-7) and iron & steel (-6).

Japan’s economy likely stalled in the current quarter, with recent data showing the country’s factory output fell the most in two years in May. The Tankan will be among data scrutinized at the Bank of Japan’s upcoming rate-setting meeting on July 20-21, when the Board produces fresh quarterly growth and inflation projections.

Europe

The ECB stated at its June forum meeting that it “will continue its policy normalisation path and will go as far as necessary to bring Euro Area inflation back to the 2% target”, President Lagarde said during a speech at the ECB’s annual forum in Portugal.

Lagarde confirmed that net asset purchases will end on July 1st and interest rates will be raised by 25bps in July, the first rate hike in 11 years. At the same time, Lagarde stressed that the central bank will be flexible when net asset purchases end and could reinvest some redemptions in bond markets where orderly transmission is at risk.

The S&P Global Eurozone Composite PMI rose to 54.8 in June from 51.9 in May, compared with the market consensus of 54. It was the lowest reading since a contraction in February 2021, with new orders for goods and services stagnating for the first time since the demand recovery started in early 2021.

Manufacturing expanded the least in 24 months, with output falling for the first time in two years. Meanwhile, growth in the services sector slowed sharply amid slower inflows of new business.

June also saw the release of the latest preliminary consumer confidence indicators that showed the Euro Area fell by 2.4 points to -23.6 in June from -21.1 in May, compared with market expectations of -20.5 and long-term average of -11.0. The reading is just short of the all-time low hit in April 2020 when Covid-19 hit Europe for the first time.

Surging inflation amid the effects of Russia’s war in Ukraine and renewed supply chain issues are weighing on purchasing power. Consumer sentiment decreased by 1.9 points to -24 in the European Union as a whole. The annual inflation rate in the Euro Area was confirmed at a record-high of 8.1% in May 2022, above 7.4% in each of the previous two months and four times higher than a year earlier.

There was a broad-based increase in prices, with energy (39.1%), food, alcohol & tobacco (7.5%), services (3.5%), and non-energy industrial goods (4.2%) giving the biggest upward pressure.

The inflation rate in the Euro Area remains well above the European Central Bank’s target of 2% and underpinned consensus that the central bank will start raising borrowing costs from July to bring it back to the target.

Over to the UK, we saw their economy expand 0.8% on quarter in the first three months of 2022, the lowest in a year, however in line with preliminary estimates. The largest contributors were information & communication and transport & storage, while production output was primarily driven by a rise in manufacturing output, and construction output rose.

Also, household final consumption expenditure grew 0.6%, whereas gross fixed capital formation grew by a revised 3.8%. Still, real household disposable income fell by 0.2%, the fourth consecutive quarter of real negative growth. The UK’s GDP remains 0.7% above its pre-pandemic level.

The current account deficit in the UK ballooned to GBP 51.7 billion (or 18.3% of GDP) in the first quarter of 2022 from GBP 7.3 billion in the prior period, surpassing market forecasts of GBP 39.8 billion. It was the largest current account shortfall since comparable data began in 1955, as the total trade gap broadened to GBP 33.4 billion from GBP 6.2 billion in the prior period, in part due to the soaring cost of fuel imports.

Additionally, the total primary income account returned to a deficit position of GBP 12.4 billion (or 2.0% of GDP) after recording a surplus of GBP 4.7 billion, as income from British assets abroad was more than offset by investment-related flows.

The total secondary income surplus was little changed at GBP 5.8 billion. The Office for National Statistics issued a warning over the figures, saying that there was an impact of changes in post-Brexit data collection on trade in goods imports, and foreign direct investment, which it is investigating.

Developments in Financial Markets

Australian Equities

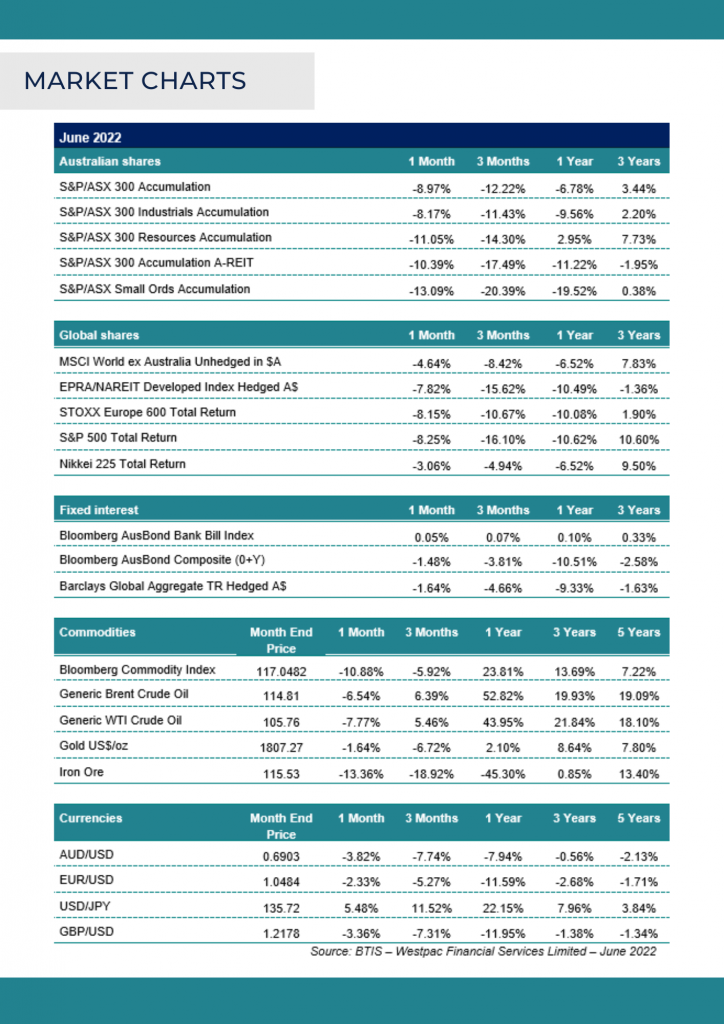

Continued concerns of the global economy falling into a recession resulted in Australian equites continuing their downward spiral throughout June. The S&P/ASX300 Accumulation Index ended the month down 8.97%, bringing the 1-year rolling return into red territory closing the financial year at -6.78%.

As for size, large caps followed the broad market selldown with the S&P/ASX100 closing the month at -8.45%, though small cap investors faced more detriment with the ASX Small Ordinaries Accumulation Index being hit much harder, ending the month down 13.09%.

Sector wise, Consumer Staples was the only Australian sector to close June in the green (+1.63%), likely buoyed by the rising inflation costs mostly passed on to consumers at the checkout. Financials were June’s worst performer at -13.10%, finishing the financial year down 7.53%.

Materials were not too far behind, taking a close second ending June down 11.14%, to bring the sector’s 1-year return to -1.26%.The sell-off in the Info Tech sector continued, with a June return of -8.96%, making it the year’s worst performer with a chilling 1-year return of -36.73%.

Although energy prices slipped through June leading the Energy sector to close at -1.06%, the strong position of the sector over the last 6 months since January has the 1-year rolling return up an impressive 24.02%.

Utilities slid 7.44% through June, though was Australia’s highest finisher for the financial year at +31.55%. Tightening financial conditions continue to rile discretionary spending, with the Consumer Discretionary sector taking a large hit posting a 1-month return of -7.44%, resulting in a 1-year return of -22.06%.

International Equities

Global share markets were vastly red too. Overall, the MSCI World Ex Australia (unhedged) returned -4.64% in June, which gives the global markets (excluding Australia) a 1-year return of -6.52%.

As for the US markets, the S&P500, the NASDAQ, and the Dow Jones Industrials Average, were all smacked in June. They closed the month -8.25%, -8.65%, and -6.56% respectively. Annual returns were -11.62%, -23.43% and -9.05% respectively.

European markets suffered the same fate through June. The Europe 600 STOXX ended the month down 8.15%, the French CAC 40 down 8.44%, the German DAX down 11.15%, and the UK’s FTSE100 down 5.76%.

Asian markets had the Japanese Nikkei 225 down 3.06% and the Korean KOSPI ending June down 13.15%. The Chinese Shanghai Composite and Hong Kong’s Hang Seng were clear outperformers in June. They managed to claw back earlier losses to end the month up a comfortable 6.66% and 2.08% respectively, though both are still under pressure for the year with their 1-year returns at -5.36% and -24.17%.

Fixed Interest

Inflation and interest rates continued to be main fare in most investors’ minds. Markets are paying close attention to global central bank deliberations with policy rates on the rise throughout most major economies.

Domestically, the Bloomberg AusBond Composite (0+Y) continued a negative track to end the month down 1.48%, bringing its 1-year return to -10.51%. The S&P/ASX Government Bond Index returned -1.64% over June, while the S&P/ASX Corporate Bond index returned -1.38%, highlighting the effect inflation is having on debt markets.

International markets saw the Barclays Global Aggregate TR Hedged index soften 1.64% over the month, translating into a -9.33% 1-year rolling return.

The Australian 10 Year bond yield ended the month at 3.62% adding 27bps over the month and 195bps since the start of 2022. While the US 10 Year yield at 3.02% rose 17bps over June.

Foreign Exchange

The USD dominated the FX markets over June as market selloffs caused investors to flee to the ‘safe-haven’ currency. The Australian dollar lost May’s gains against the USD, with the AUD/USD ending the month down 3.82% at 0.6903.

Other major currencies also fell against the USD with the EUR and GBP ending the month down 2.33% and 3.36% respectively, to 1.0484 and 1.2178. The Japanese Yen played to a similar tune, falling against the USD with the USD/JPY pair ending the month up 5.48%, at 135.72.

Commodities

Commodities had a mixed month with the Bloomberg Commodity Index down 10.88% (though up 23.81% for the year). The Dow Jones Commodity Index also closed June in the red, with a return of -5.19%.

No doubt to the delight of many drivers, the energy sector’s bull run stumbled somewhat, with Brent Crude oil down 6.54% closing at USD$114.81. Metals also fell, with Iron Ore down 13.36% to close at USD$115.53 per tonne, and gold ending 1.64% down to finish June off at USD$1807.27 an ounce.

If you would like to view this Market Review & Commentary in PDF, please click here.

The information provided on and made available through this website does not constitute financial product advice. The information is of a general nature only and does not take into account your individual objectives, financial situation or needs. It should not be used, relied upon, or treated as a substitute for specific professional advice. We recommend that you obtain your own independent professional advice before making any decision in relation to your particular requirements or circumstances. Centaur Financial Services do not warrant the accuracy, completeness or currency of the information provided on and made available through this website. Past performance of any product discussed on this website is not indicative of future performance.